Along with fireworks, champagne, and resolutions, we rang in 2020 with price increases on hundreds of drugs. New year, same challenge. However, even amid increasing prices, you can build a comprehensive cost containment strategy. Foundational to developing meaningful methods to cut spend is understanding the origin of these annual price increases; you must know where, and to whom, your pharmacy dollars are going.

Who determines drug prices?

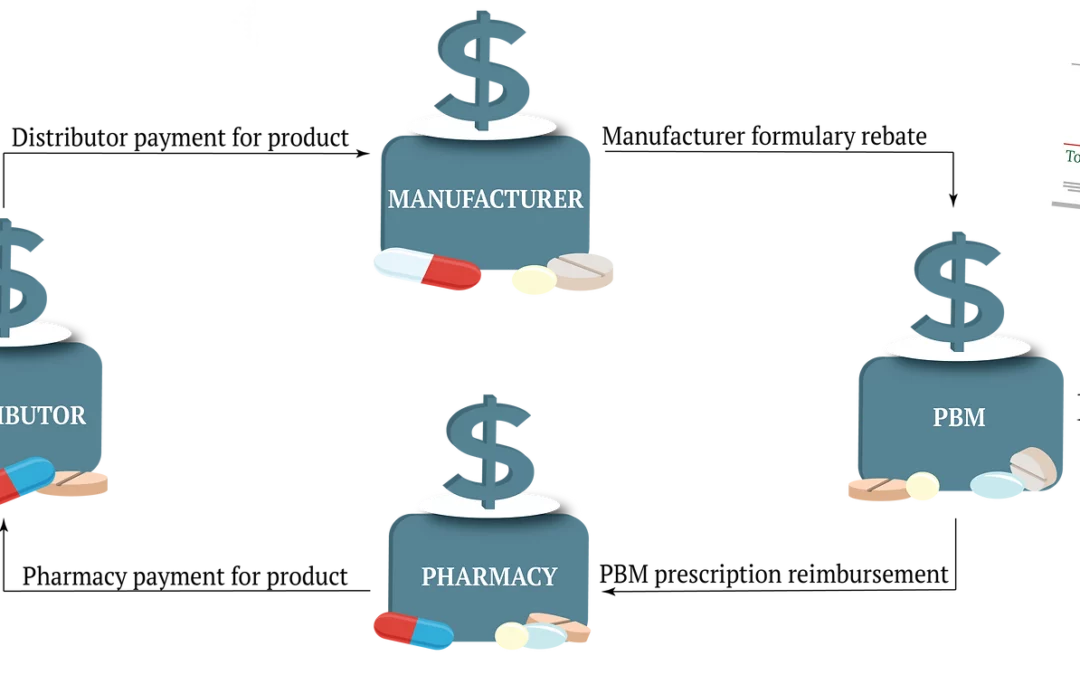

The process of setting drug prices is complex. Pharmaceutical companies grab the headlines each January, but there are other major parties involved in setting medication price points. Below we look at the four major players: manufacturers, distributors, pharmacies and PBMs.

1. Manufacturers

This year pharmaceutical companies, the manufacturers of prescription drugs, increased prices on over 500 drugs.[1] Many common, frequently utilized drugs like Eliquis, Jardiance, Tradjenta, and Chantix saw increases averaging 5.1%.[2] Manufacturers justify these percentages as socially conscious or necessary for research and development.

However, even “small” increases, when applied to a group of several hundred participants, result in a substantial financial burden to plans and participants.

For example, the price of immunology drug Humira 40 mg Pen 2pk rose by 9% this year. Last year, the average wholesale price (AWP), the arbitrary price point set by manufacturers, of Humira 40 mg Pen 2pk was $6,028.91. In 2020 the AWP is $6,668.36. If a group of 2,000 employees averaged 30 claims for Humira 40 mg Pen 2pk per month in 2019, they can expect their annual cost in 2020 to be around $165,402.00, for just this one drug.

2. Distributors

Pharmaceutical distributors purchase medications in bulk from manufacturers then sell those drugs to pharmacies, care facilities, hospitals, and clinics. The logistical complexity of supplying thousands of medications to thousands of pharmacies results in mark-ups averaging 2%-5% of the wholesale acquisition cost (WAC) distributors pay manufacturers. WAC typically increases one to four times per year when drug manufacturers raise prices. While these markups seem minimal, they can quickly add up for plan sponsors who cover thousands of drugs for their participants.

3. Pharmacies

If you have ever shopped around for the best deal on a medication you know there can be a big price difference between pharmacies. Because drug prices are not regulated, pharmacies, like manufacturers and distributors, can set price points to make money. When determining drug prices, pharmacies consider:

-

Wholesale acquisition costs

-

Third-part contracts

-

Dispensing fees

-

Operating expenses

These considerations all attribute to the final price of medications. They are also why the same drug may be less expensive at a chain pharmacy rather than a local pharmacy.

For example, the price of Sertraline 100mg #30 is $17.10 at a national chain pharmacy in the Midwest. The same drug, at the same dose and quantity, is $11.13 at a nearby independently owned pharmacy. The difference of only $6.00 may not seem substantial, but at 30 claims per month, it adds up to $180.00 per month or $2,160.00 per year in plan or participant spend.

4. Pharmacy Benefit Managers

The infamous industry middlemen, Pharmacy Benefit Managers (PBMs), are companies that manage prescription drug benefits on behalf of insurers and self-insured employers. PBMs influence drug prices in three major ways:

- PBMs develop formularies that assign drugs to specific pricing tiers, which may affect what drugs participants use based on copay and out-of-pocket costs.

- PBMs negotiate rebates and discounts with manufacturers, pharmacies, and insurers.

- PBMs negotiate reimbursements with pharmacies for drugs dispensed.

Due to purchasing power, PBMs are often able to negotiate lower drug prices with manufacturers and distributors, which could result in lower costs for plan sponsors. However, PBMs also use their relationship with manufacturers to encourage the use of more expensive drugs over lower priced drugs so they can receive a larger rebate. As a result, plans and participants may pay higher out-of-pocket costs. Transparency of PBM contracts, rebates, and pricing are under intense scrutiny as an avenue for cost regulation.

Managing cost. Regaining Control.

Obviously, the process of establishing drug costs is, at best, convoluted. A lack of regulation, too many invested parties, and ambiguous contracts result in skyrocketing costs for the end client. Plan sponsors often feel as if they have little control over how much their plan and participants pay, which makes it increasingly difficult to offer high level pharmacy benefits.

However, there are solutions to regain control of pharmacy costs. Start by questioning where your money is going. Are participants utilizing the least expensive pharmacies in your network? Is your formulary structured to promote low-cost drugs over higher cost medications? Are you receiving agreed upon rebates and discounts from your PBM?

Controlling pharmacy spend means digging into your pharmacy claims, initiating discussions with relevant stakeholders, and examining your spending habits. While this year may have begun with seemingly uncontrollable price increases, February is coming and plan sponsors can resolve to contain pharmacy costs by understanding who determines drug prices and what they can do cut spend.

[1] https://www.in-pharmatechnologist.com/Article/2020/01/08/Drugmakers-announce-drug-prices-increases-for-2020

[2] https://www.fiercepharma.com/pharma/novartis-merck-and-allergan-raise-drug-prices-to-start-2020-joining-big-pharma-peers

Updated: Feb 3, 2021